February 27, 2023

Stellantis Announces Strategic Copper Investment in Argentina, Reinforcing Commitment to Reaching Carbon Net Zero by 2038

- $155 million investment in McEwen Copper helps Stellantis secure projected copper demand starting in 2027

- Stellantis becomes second largest shareholder

- Sustainable copper mine, Los Azules project, to be located in Argentina

- Cathode copper is a strategic raw material for the production of electric vehicle batteries

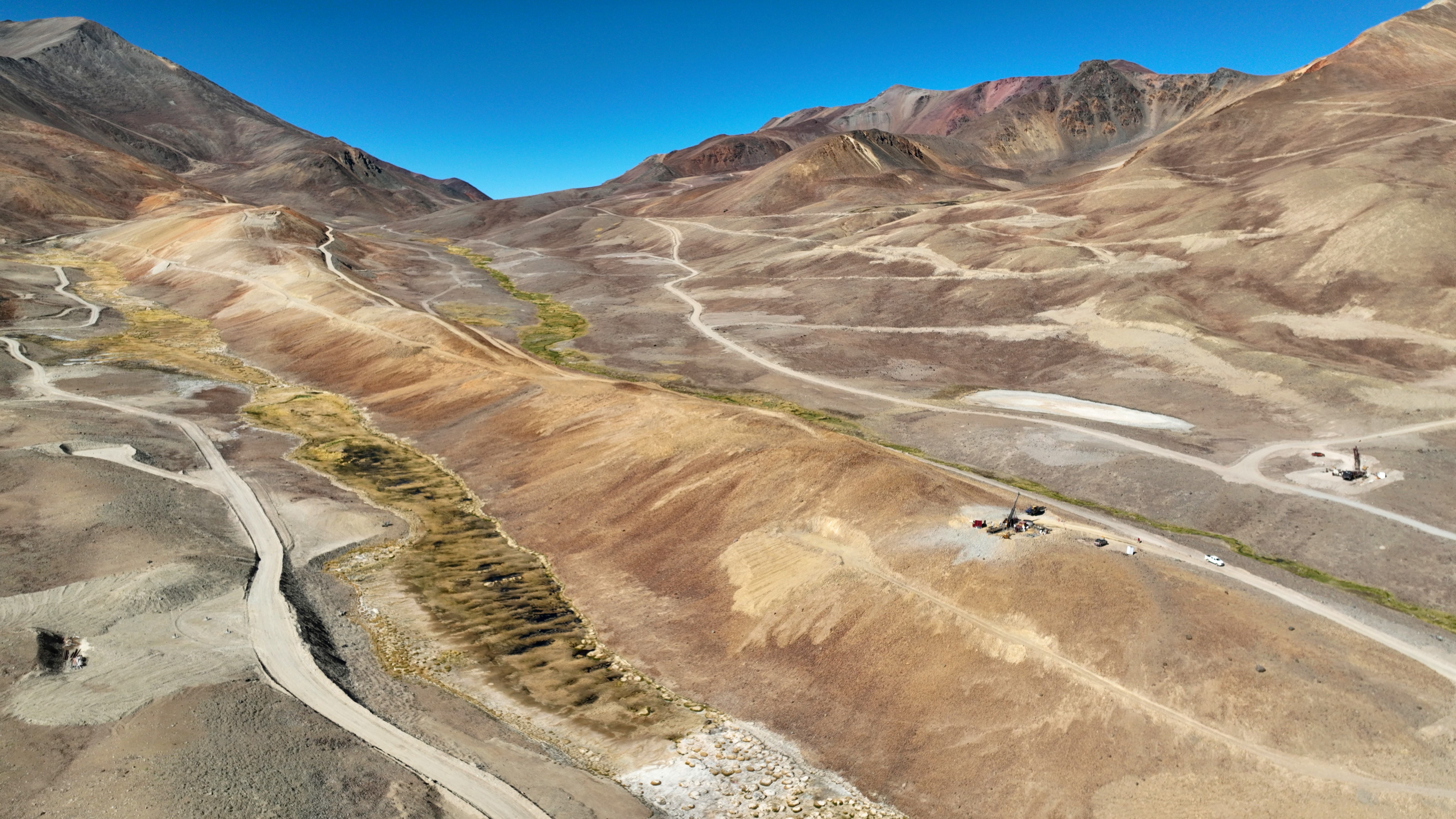

AMSTERDAM - Stellantis today announced a $155 million investment in a project located in Argentina, which will make a major contribution to the Company’s plan to become carbon net zero by 2038. The Company is acquiring a 14.2% equity stake in McEwen Copper, a subsidiary of Canadian mining company McEwen Mining, which owns the Los Azules project in Argentina and the Elder Creek project in Nevada, USA.

With this stake, Stellantis will become McEwen Copper’s second largest shareholder, along with Rio Tinto, through its copper leaching technology venture, Nuton. Los Azules plans to produce 100,000 tons per year of cathode copper at 99.9% purity starting in 2027 and the resources can secure the operation for at least 33 years.

“Stellantis intends to lead the industry with the commitment to be carbon net zero by 2038 – a goal that requires innovation and a complete redefinition of the entire business,” said Carlos Tavares, Stellantis CEO. “We are taking important steps in Argentina and Brazil, with the aim of decarbonizing mobility and ensuring strategic supplies of raw materials necessary for the success of the Company’s global electrification plans.”

Copper is a strategic raw material for the future of electric mobility, and it is estimated that global demand for the conductive metal will triple in the coming years. By making this investment in one of the top 10 international projects in development of this commodity, Stellantis will be able to supply some of the projected copper demand starting in 2027.

McEwen Copper Chief Executive Rob McEwen said: “Stellantis and McEwen are ideal partners for a large project like Los Azules. Together, we share a collective vision to build a mine for the future based on regenerative principles and innovative technologies, that can achieve net-zero carbon emissions by 2038! We are committed to delivering green copper to Argentina and the world, a product that will contribute to the electrification of transportation and the protection of our atmosphere.”

The announcement reinforces South America’s participation in the implementation of the Dare Forward 2030 long-term strategic plan committed to cutting-edge freedom of mobility.

As part of the Dare Forward 2030 strategic plan, Stellantis expects to achieve a 100% passenger car battery electric vehicle (“BEV”) sales mix in Europe and a 50% passenger car and light-duty truck BEV sales mix in the United States by 2030. In Brazil, it is targeting approximately 20% low emission vehicle (“LEV”) sales mix by the end of the decade. The plan is anchored in an ambitious decarbonization strategy consistent with science-based recommendations. Through aggressive and clear targets, by 2030(1) it plans to reduce its carbon emissions footprint by half versus 2021 metrics, putting the Company on track to achieve carbon net zero by 2038(2).

(1) scopes 1-2-3 intensity tons of CO2 equivalent/vehicle

(2) with single-digit % compensation in 2038

ABOUT STELLANTIS

Stellantis N.V. (NYSE: STLA / Euronext Milan: STLAM / Euronext Paris: STLAP) is one of the world's leading automakers and a mobility provider. Its storied and iconic brands embody the passion of their visionary founders and today’s customers in their innovative products and services, including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys. Powered by our diversity, we lead the way the world moves – aspiring to become the greatest sustainable mobility tech company, not the biggest, while creating added value for all stakeholders as well as the communities in which it operates. For more information, visit www.stellantis.com.

ABOUT MCEWEN COPPER

McEwen Copper Inc. holds 100% interest in the Los Azules copper project in San Juan, Argentina and the Elder Creek project in Nevada, USA. Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). Its current copper resources are estimated at 10.2 billion pounds at a grade of 0.48% Cu (Indicated category) and an additional 19.3 billion pounds at a grade of 0.33% Cu (Inferred category).

STELLANTIS FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements. In particular, statements regarding future events and anticipated results of operations, business strategies, the anticipated benefits of the proposed transaction, future financial and operating results, the anticipated closing date for the proposed transaction and other anticipated aspects of our operations or operating results are forward-looking statements. These statements may include terms such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, or similar terms. Forward-looking statements are not guarantees of future performance. Rather, they are based on Stellantis’ current state of knowledge, future expectations and projections about future events and are by their nature, subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them.

Actual results may differ materially from those expressed in forward-looking statements as a result of a variety of factors, including: the impact of the COVID-19 pandemic, the ability of Stellantis to launch new products successfully and to maintain vehicle shipment volumes; changes in the global financial markets, general economic environment and changes in demand for automotive products, which is subject to cyclicality; changes in local economic and political conditions, changes in trade policy and the imposition of global and regional tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in tax laws and regulations; Stellantis’ ability to expand certain of their brands globally; its ability to offer innovative, attractive products; its ability to develop, manufacture and sell vehicles with advanced features including enhanced electrification, connectivity and autonomous-driving characteristics; various types of claims, lawsuits, governmental investigations and other contingencies, including product liability and warranty claims and environmental claims, investigations and lawsuits; material operating expenditures in relation to compliance with environmental, health and safety regulations; the intense level of competition in the automotive industry, which may increase due to consolidation; exposure to shortfalls in the funding of Stellantis’ defined benefit pension plans; the ability to provide or arrange for access to adequate financing for dealers and retail customers and associated risks related to the establishment and operations of financial services companies; the ability to access funding to execute Stellantis’ business plans and improve its businesses, financial condition and results of operations; a significant malfunction, disruption or security breach compromising information technology systems or the electronic control systems contained in Stellantis’ vehicles; Stellantis’ ability to realize anticipated benefits from joint venture arrangements; disruptions arising from political, social and economic instability; risks associated with our relationships with employees, dealers and suppliers; increases in costs, disruptions of supply or shortages of raw materials, parts, components and systems used in Stellantis’ vehicles; developments in labor and industrial relations and developments in applicable labor laws; exchange rate fluctuations, interest rate changes, credit risk and other market risks; political and civil unrest; earthquakes or other disasters; and other risks and uncertainties.

Any forward-looking statements contained in this communication speak only as of the date of this document and Stellantis disclaims any obligation to update or revise publicly forward-looking statements. Further information concerning Stellantis and its businesses, including factors that could materially affect Stellantis’ financial results, is included in Stellantis’ reports and filings with the U.S. Securities and Exchange Commission and AFM.